The Wealth of Statesmen

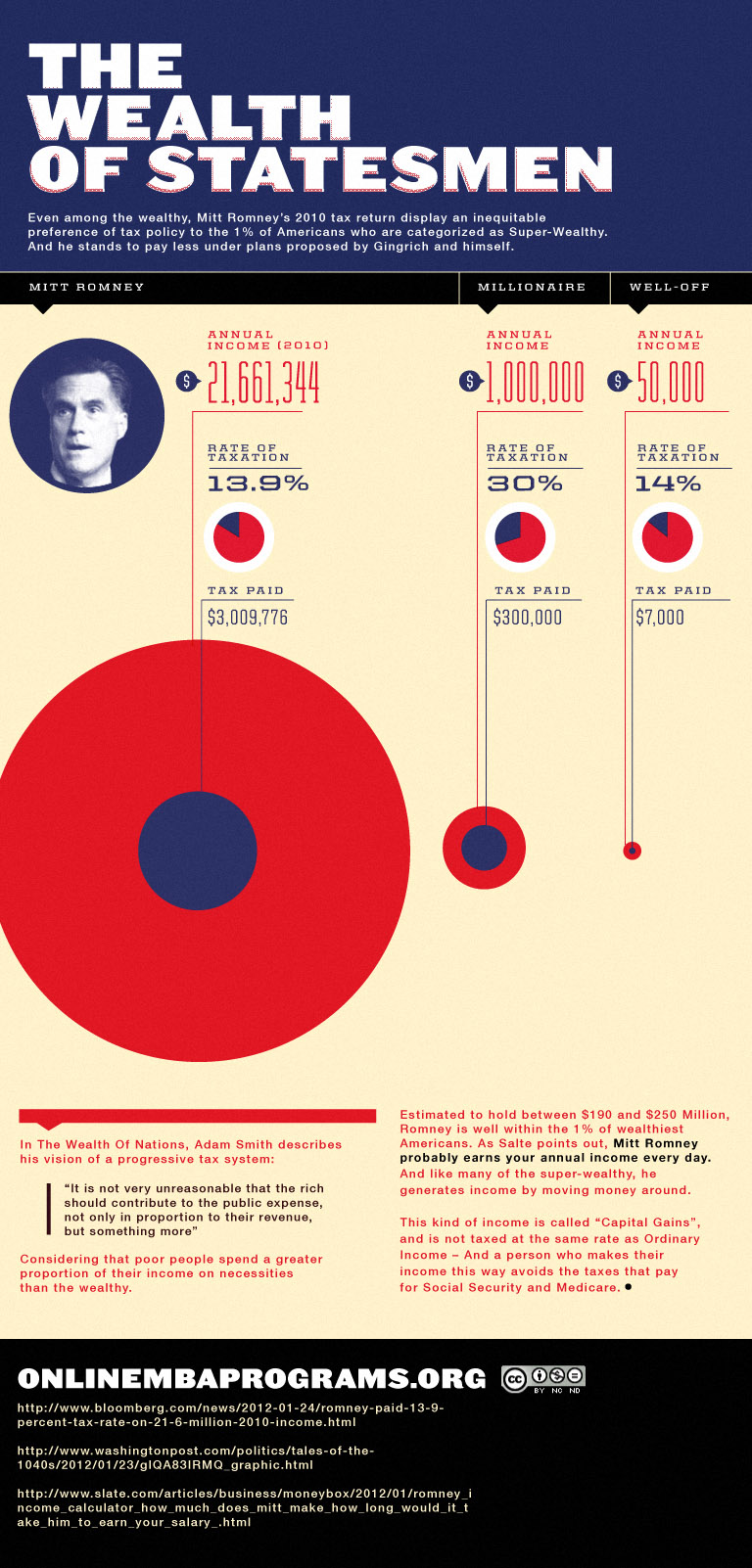

I ran across an info-graphic visually demonstrating how much less Mitt Romney pays in taxes, as a percentage of his income, implying that's because he's part of the 1%, the "Super-Wealthy". The info-graphic is very deceptive. Can you figure out why? Think about it before skipping to the discussion below the image.

The reason this chart is deceptive is because the income of Romney is different than the income of the simple millionaire. A tax rate of 30% would imply that the millionaire earned normal income. We already know that the majority of Romney's income comes from capital gains. Capital gains are taxed differently than normal income, and always have been.

The graphic is comparing apples and oranges, but would try to lead us to believe that the reason Romney pays less is "because he's part of the 1%".

In most developed countries, investment income (capital gains, dividends and interest) are taxed differently than regular income. Although there remains healthy debate on the topic, most economist agree that the lower investment income is taxed, the better off is the society. Many economists argue that investment income shouldn't be taxed at all, thereby maximizing the incentive for people to make capital investment. (And keep in mind, that American companies — the ones providing these capital returns — pay among the highest corporate tax rates in the world on the normal income they make.)

The image comparatively suggests that it'd be better if Romney paid 30% on his capital income, just like the millionaire does on his normal income. Would you like to see what a country looks like that levies 27% tax on investment income? Spain, where the unemployment rate among the youth in the area where I live has reached 50%.

Of course, that's an overly simplistic statement, too; Spain's situation is by no means exclusively due to their capital gains tax. But it would be instructive for people supporting an increase on investment income taxation in America to look around the world and through history, to see what countries look like that levy high rates on such income.

As a final note, I hate seeing this kind of simplistic and misleading political advertising. I also observe that it's the prominent strategy employed by both liberals and conservatives alike. That such advertising is effective is a reflection of how uninformed we are, and how little time we invest nowadays to even try to understand issues.

Enjoy this article? — You can find similar content via the category and tag links below.

Categories — Society

Tags — Economics

Questions or comments? — Feel free to email me using the contact form below, or reach out on Twitter.