Paying one’s “fair share” of taxes

In this article about Roger Ver's $100,000 bitcoin bounty to Bernie Sanders for a debate on the topic of patriotism, we come across this quote (emphasis added by me):

These great lovers of America who made their money in this country, when you ask them to start paying their fair share of taxes, they’re running abroad. — Bernie Sanders

The obvious problem with this is that Sanders's opinion of what constitutes one's "fair share" is likely to be quite different than that of, say, Milton Friedman.

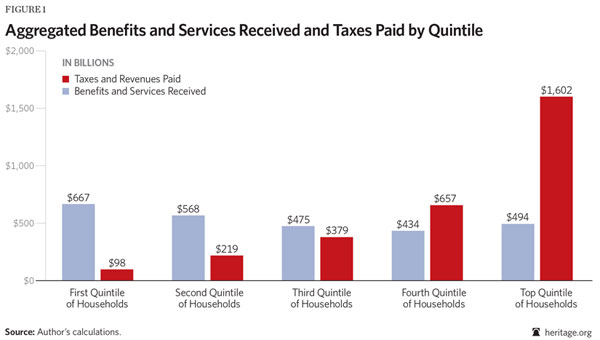

And in the context of Sanders's desire to raise taxes on the wealthy, it's probably worthwhile to take a moment to review the current situation in terms of taxes paid versus benefits received across all income levels:

Enjoy this article? — You can find similar content via the category and tag links below.

Categories — Society

Tags — Taxes

Questions or comments? — Feel free to email me using the contact form below, or reach out on Twitter.