Pendle Finance

One of the use cases of smart contract blockchain networks that has always excited me most is programmable, composable finance. In that domain, an interesting project I’ve been paying attention to recently is @pendle_fi — Pendle Finance.

What does Pendle do? In a nutshell, they take a yield bearing asset, and separate the yield from the underlying asset—such that traders, or other smart contracts through composability, can create strategies that make independent use of those components.

As an example, the @LidoFinance platform allows users to deposit ETH and receive back a token, “stETH”, that represents staked ETH. The stETH token is yield bearing, in the sense that it allows the holder to receive a pro-rata share of the yield earned from the staked ETH.

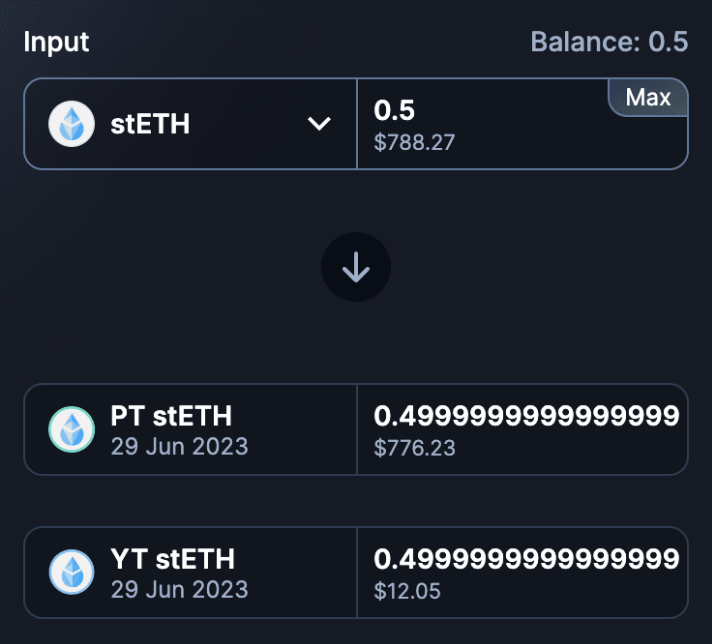

In this example, Pendle allow a user to deposit stETH, and receive back two tokens—“PT-stETH”, which represents the underlying asset ETH, and “YT-stETH”, which represents the yield on staked ETH.

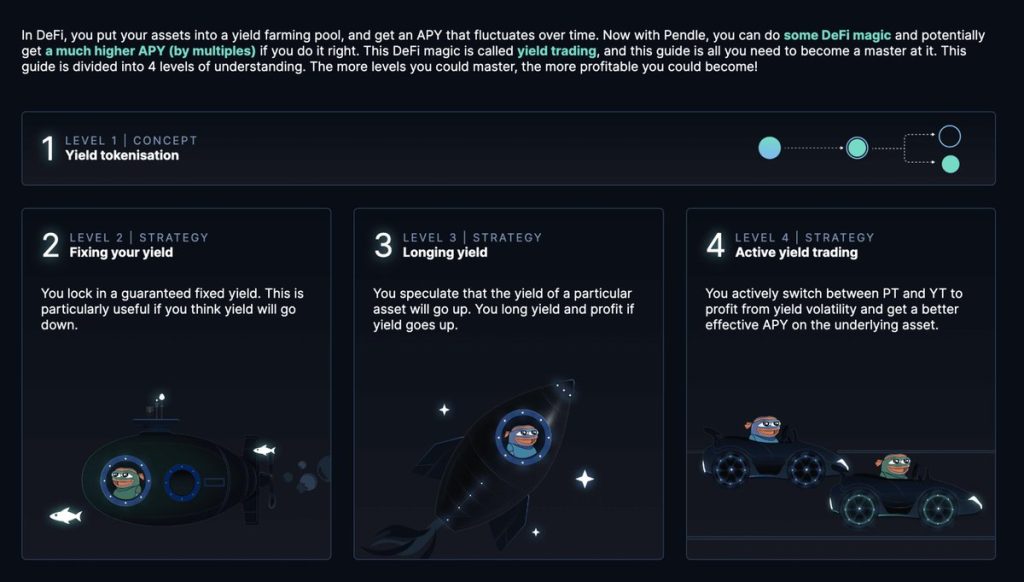

Once the underlying asset and its yield have been decomposed, a world of strategies become available, and the “Learn” section of the Pendle site provides a peek into the wealth of possibilities

Of course, trading strategies require liquidity, and Pendle incentivize people to provide liquidity through the “veToken” model popularized by Curve—i.e. locking PENDLE for up to two years “boosts” the incentives, from 22.8% to 53.1% in the case of the PT-stETH/ETH pool.

While not an endorsement, and certainly not financial advice, seeing what @tn_pendle and @pendle_fi are doing at Pendle is a refreshing reminder of why I got excited about smart contract blockchains in the first place!

This article was first posted as a thread on Twitter.

Enjoy this article? — You can find similar content via the category and tag links below.

Categories — Crypto

Questions or comments? — Feel free to email me using the contact form below, or reach out on Twitter.